Number of variables involved

- Univariate data analysis - distribution of single variable

- Bivariate data analysis - relationship between two variables

- Multivariate data analysis - relationship between many variables at once, usually focusing on the relationship between two while conditioning for others

3 / 32

Types of variables

- Numerical variables can be classified as continuous or discrete based on whether or not the variable can take on an infinite number of values or only non-negative whole numbers, respectively.

- If the variable is categorical, we can determine if it is ordinal based on whether or not the levels have a natural ordering.

4 / 32

Data: Lending Club

Thousands of loans made through the Lending Club, which is a platform that allows individuals to lend to other individuals

Not all loans are created equal -- ease of getting a loan depends on (apparent) ability to pay back the loan

Data includes loans made, these are not loan applications

6 / 32

Take a peek at data

library(openintro)glimpse(loans_full_schema)## Rows: 10,000## Columns: 55## $ emp_title <chr> "global config enginee…## $ emp_length <dbl> 3, 10, 3, 1, 10, NA, 1…## $ state <fct> NJ, HI, WI, PA, CA, KY…## $ homeownership <fct> MORTGAGE, RENT, RENT, …## $ annual_income <dbl> 90000, 40000, 40000, 3…## $ verified_income <fct> Verified, Not Verified…## $ debt_to_income <dbl> 18.01, 5.04, 21.15, 10…## $ annual_income_joint <dbl> NA, NA, NA, NA, 57000,…## $ verification_income_joint <fct> , , , , Verified, , No…## $ debt_to_income_joint <dbl> NA, NA, NA, NA, 37.66,…## $ delinq_2y <int> 0, 0, 0, 0, 0, 1, 0, 1…## $ months_since_last_delinq <int> 38, NA, 28, NA, NA, 3,…## $ earliest_credit_line <dbl> 2001, 1996, 2006, 2007…## $ inquiries_last_12m <int> 6, 1, 4, 0, 7, 6, 1, 1…## $ total_credit_lines <int> 28, 30, 31, 4, 22, 32,…## $ open_credit_lines <int> 10, 14, 10, 4, 16, 12,…...7 / 32

Selected variables

loans <- loans_full_schema %>% select(loan_amount, interest_rate, term, grade, state, annual_income, homeownership, debt_to_income)glimpse(loans)## Rows: 10,000## Columns: 8## $ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 5000, 2…## $ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6.72, …## $ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36, 36, …## $ grade <ord> C, C, D, A, C, A, C, B, C, A, C, B, C, B…## $ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV, IL, …## $ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, 34000…## $ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, OWN, M…## $ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6.46, …8 / 32

Selected variables

| variable | description |

|---|---|

loan_amount |

Amount of the loan received, in US dollars |

interest_rate |

Interest rate on the loan, in an annual percentage |

term |

The length of the loan, which is always set as a whole number of months |

grade |

Loan grade, which takes a values A through G and represents the quality of the loan and its likelihood of being repaid |

state |

US state where the borrower resides |

annual_income |

Borrower’s annual income, including any second income, in US dollars |

homeownership |

Indicates whether the person owns, owns but has a mortgage, or rents |

debt_to_income |

Debt-to-income ratio |

9 / 32

Variable types

| variable | type |

|---|---|

loan_amount |

numerical, continuous |

interest_rate |

numerical, continuous |

term |

numerical, discrete |

grade |

categorical, ordinal |

state |

categorical, not ordinal |

annual_income |

numerical, continuous |

homeownership |

categorical, not ordinal |

debt_to_income |

numerical, continuous |

10 / 32

Describing shapes of numerical distributions

- shape:

- skewness: right-skewed, left-skewed, symmetric (skew is to the side of the longer tail)

- modality: unimodal, bimodal, multimodal, uniform

- center: mean (

mean), median (median), mode (not always useful) - spread: range (

range), standard deviation (sd), inter-quartile range (IQR) - unusual observations

12 / 32

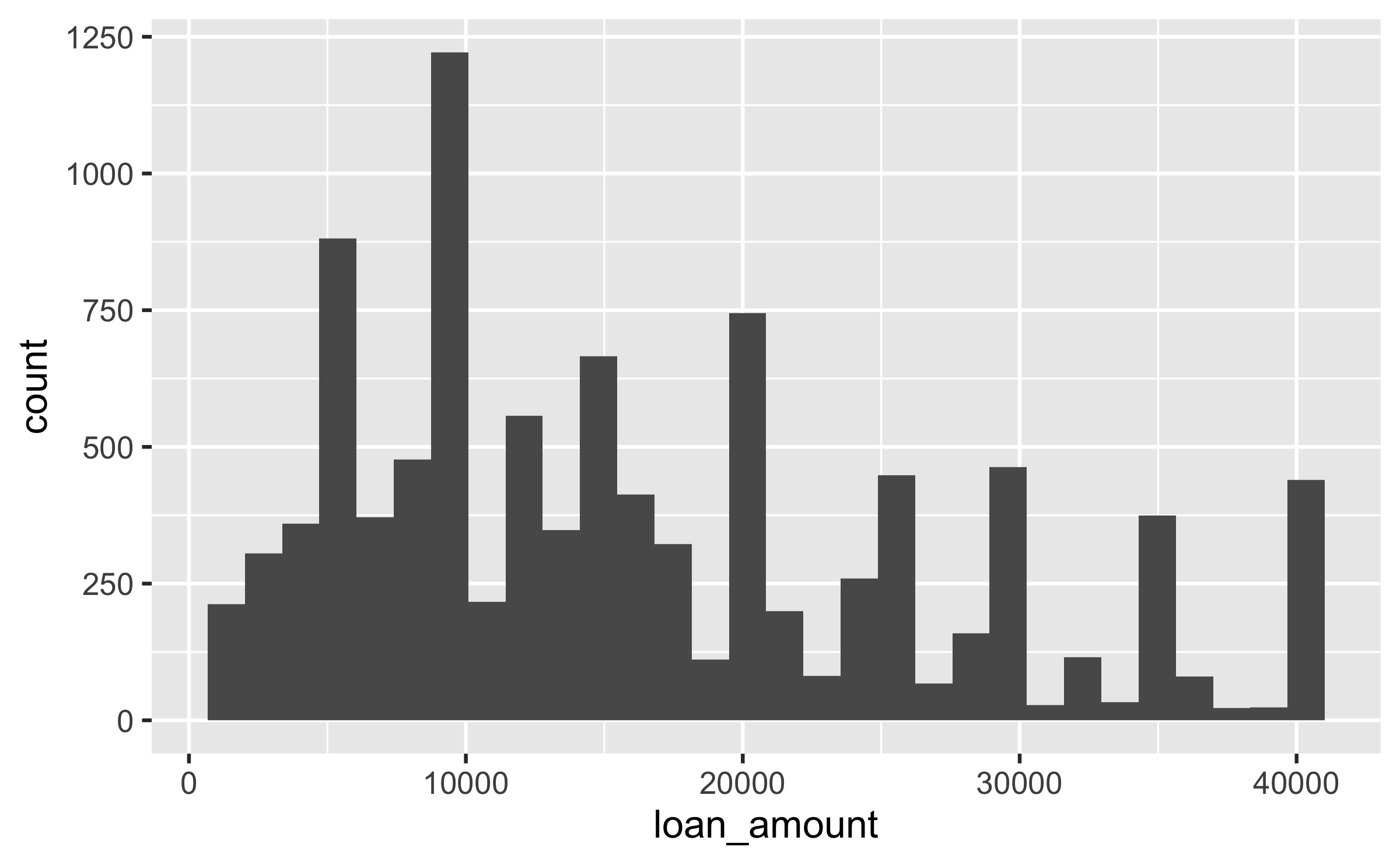

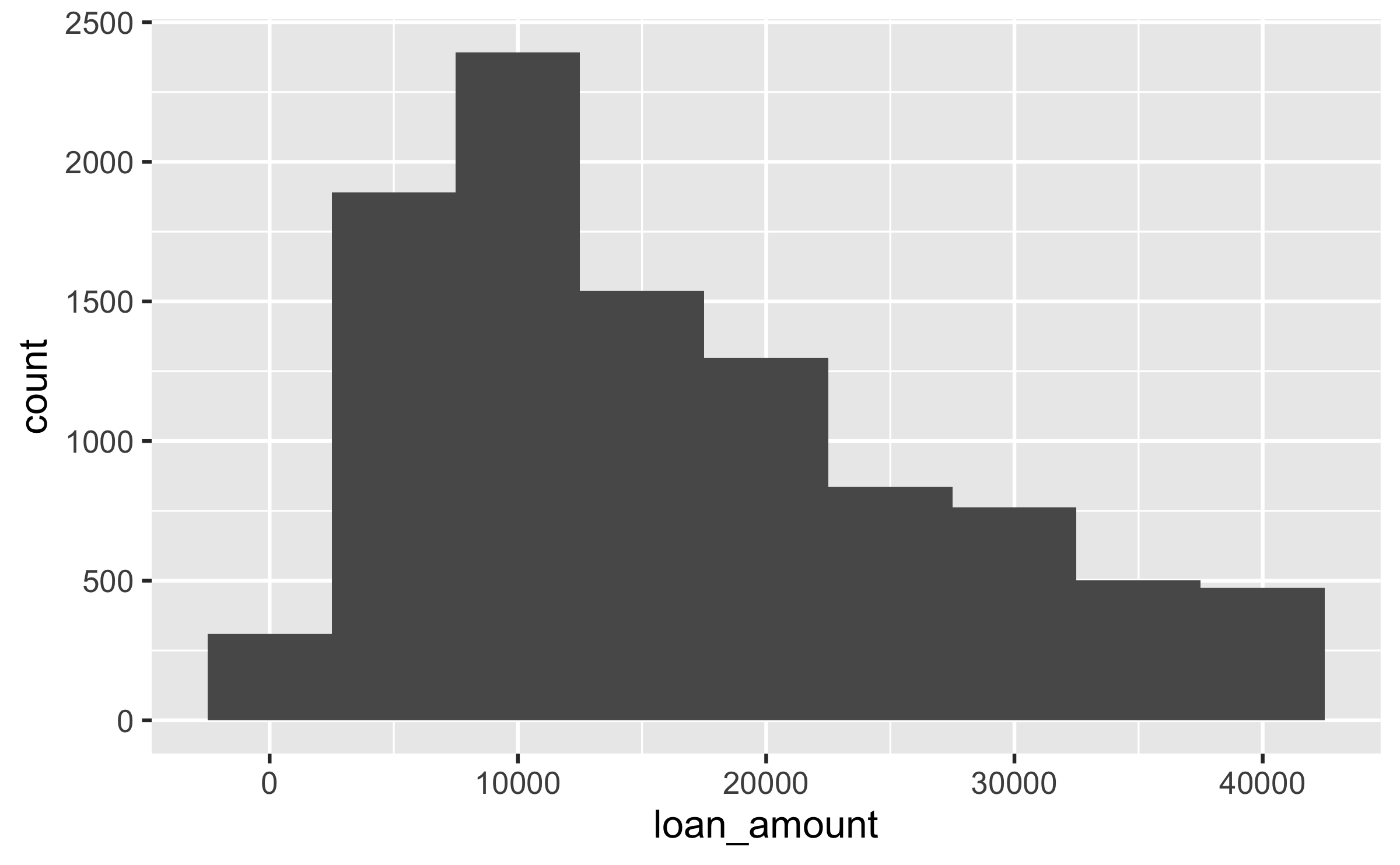

Histogram

ggplot(loans, aes(x = loan_amount)) + geom_histogram()## `stat_bin()` using `bins = 30`. Pick better value with## `binwidth`.

14 / 32

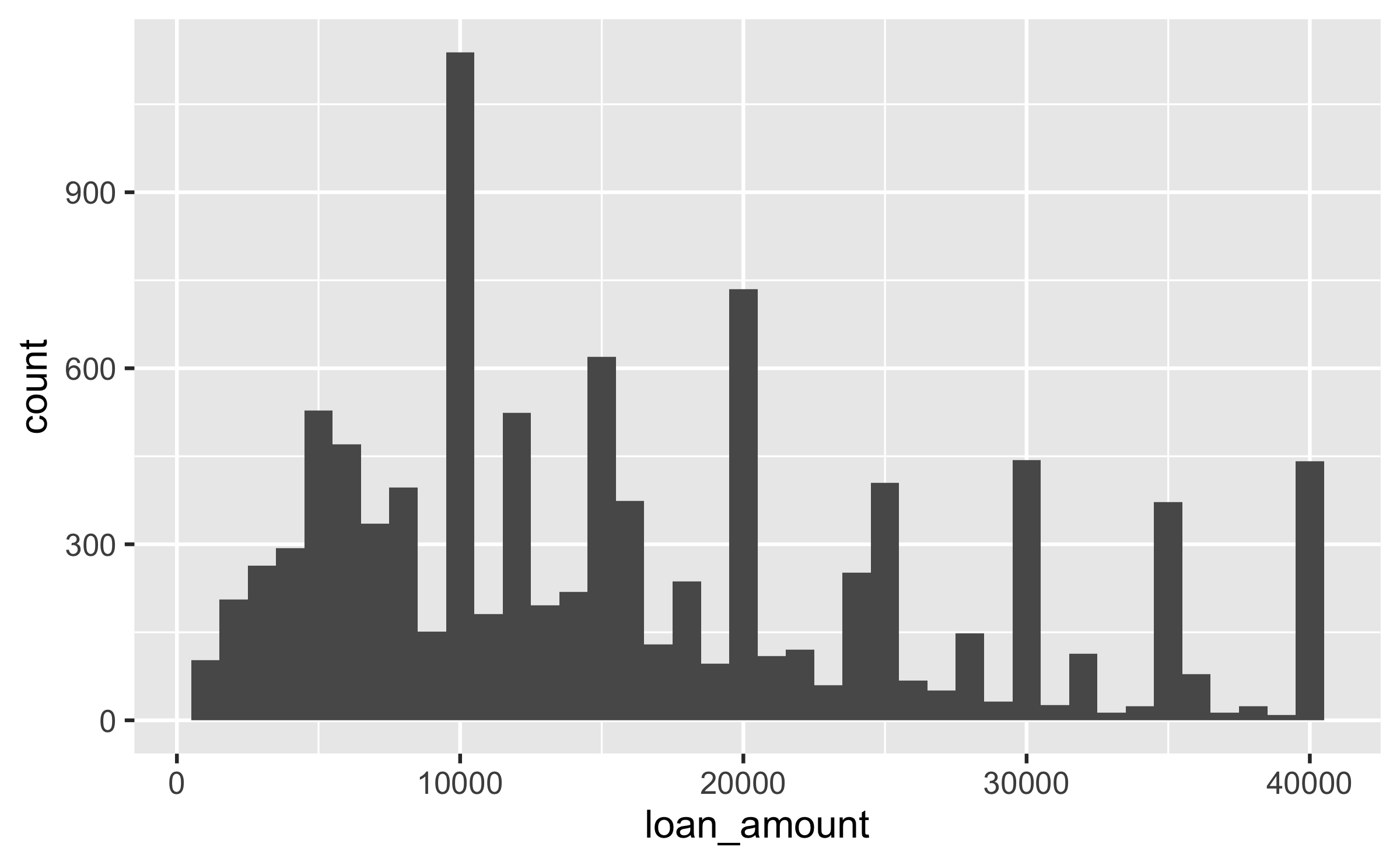

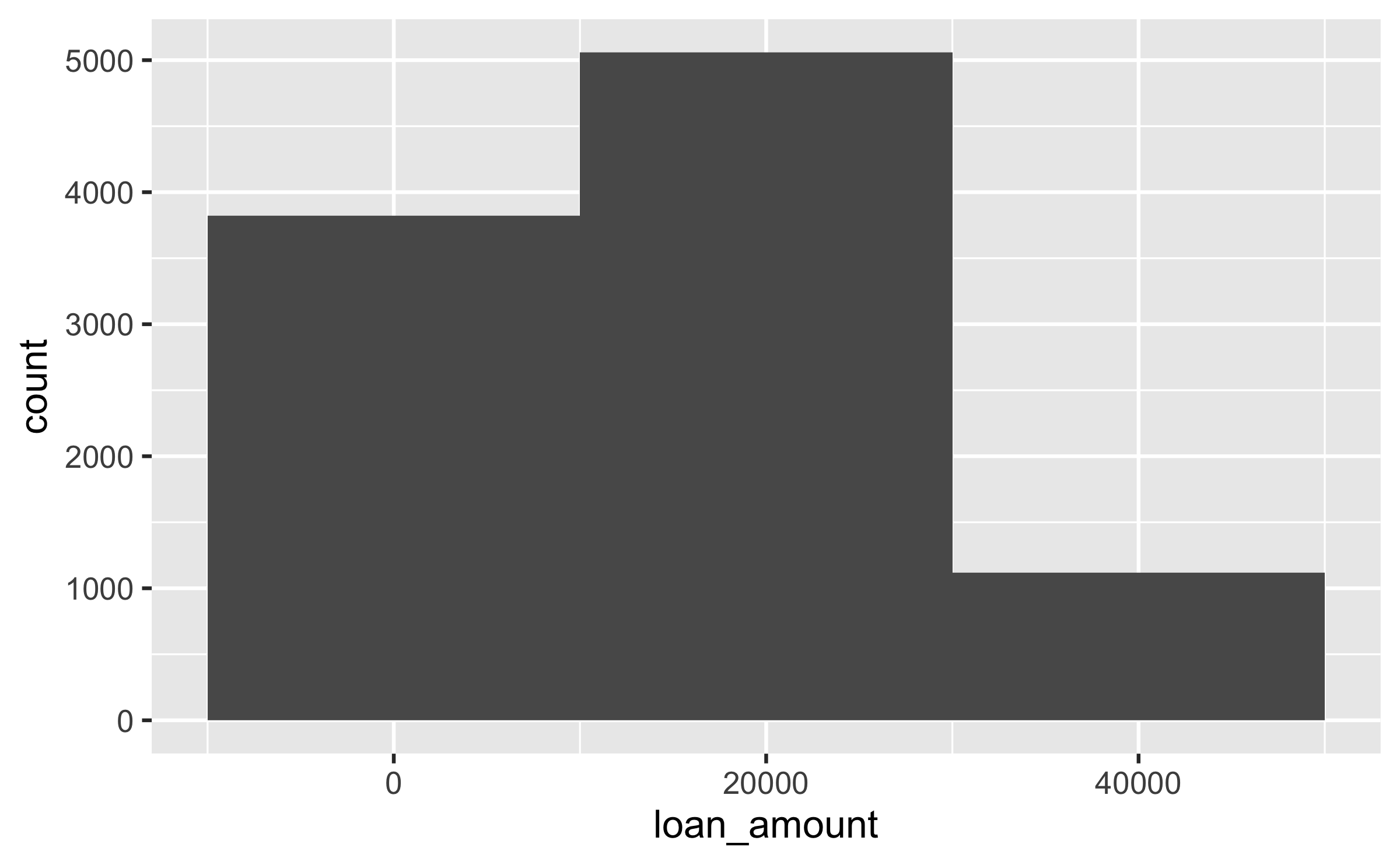

Histograms and binwidth

ggplot(loans, aes(x = loan_amount)) + geom_histogram(binwidth = 1000)

ggplot(loans, aes(x = loan_amount)) + geom_histogram(binwidth = 5000)

ggplot(loans, aes(x = loan_amount)) + geom_histogram(binwidth = 20000)

15 / 32

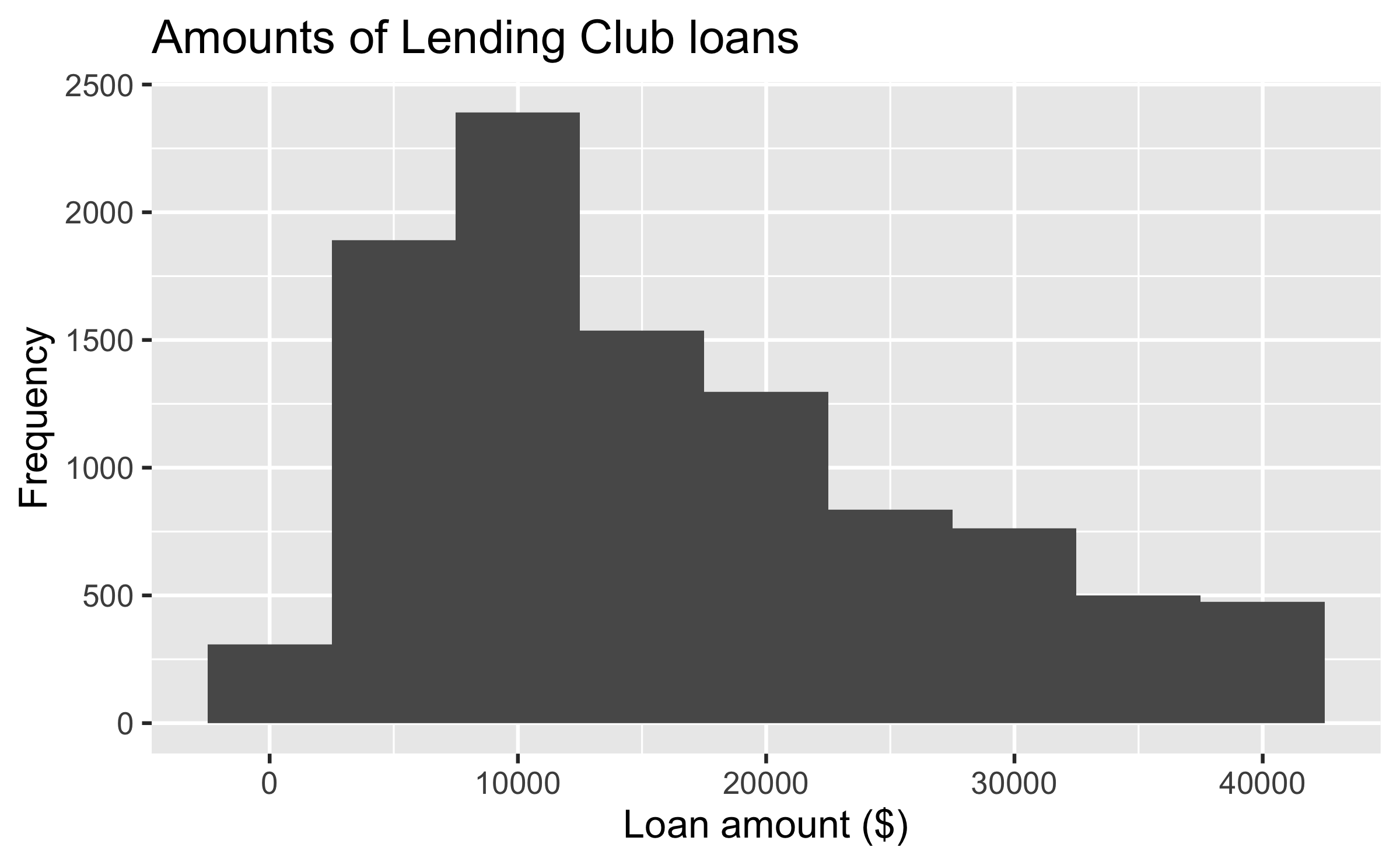

Customizing histograms

ggplot(loans, aes(x = loan_amount)) + geom_histogram(binwidth = 5000) + labs( x = "Loan amount ($)", y = "Frequency", title = "Amounts of Lending Club loans" )16 / 32

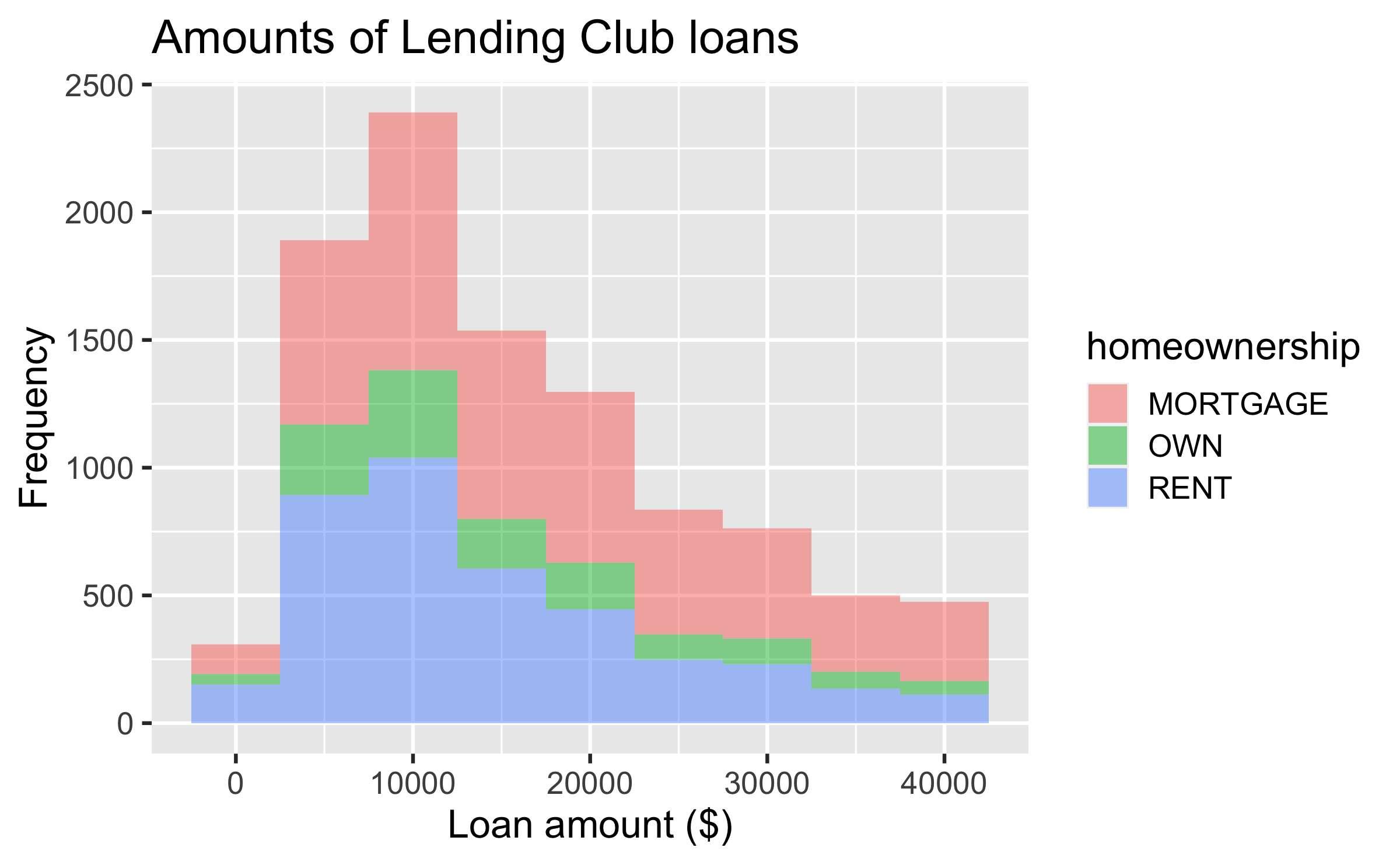

Fill with a categorical variable

ggplot(loans, aes(x = loan_amount, fill = homeownership)) + geom_histogram(binwidth = 5000, alpha = 0.5) + labs( x = "Loan amount ($)", y = "Frequency", title = "Amounts of Lending Club loans" )17 / 32

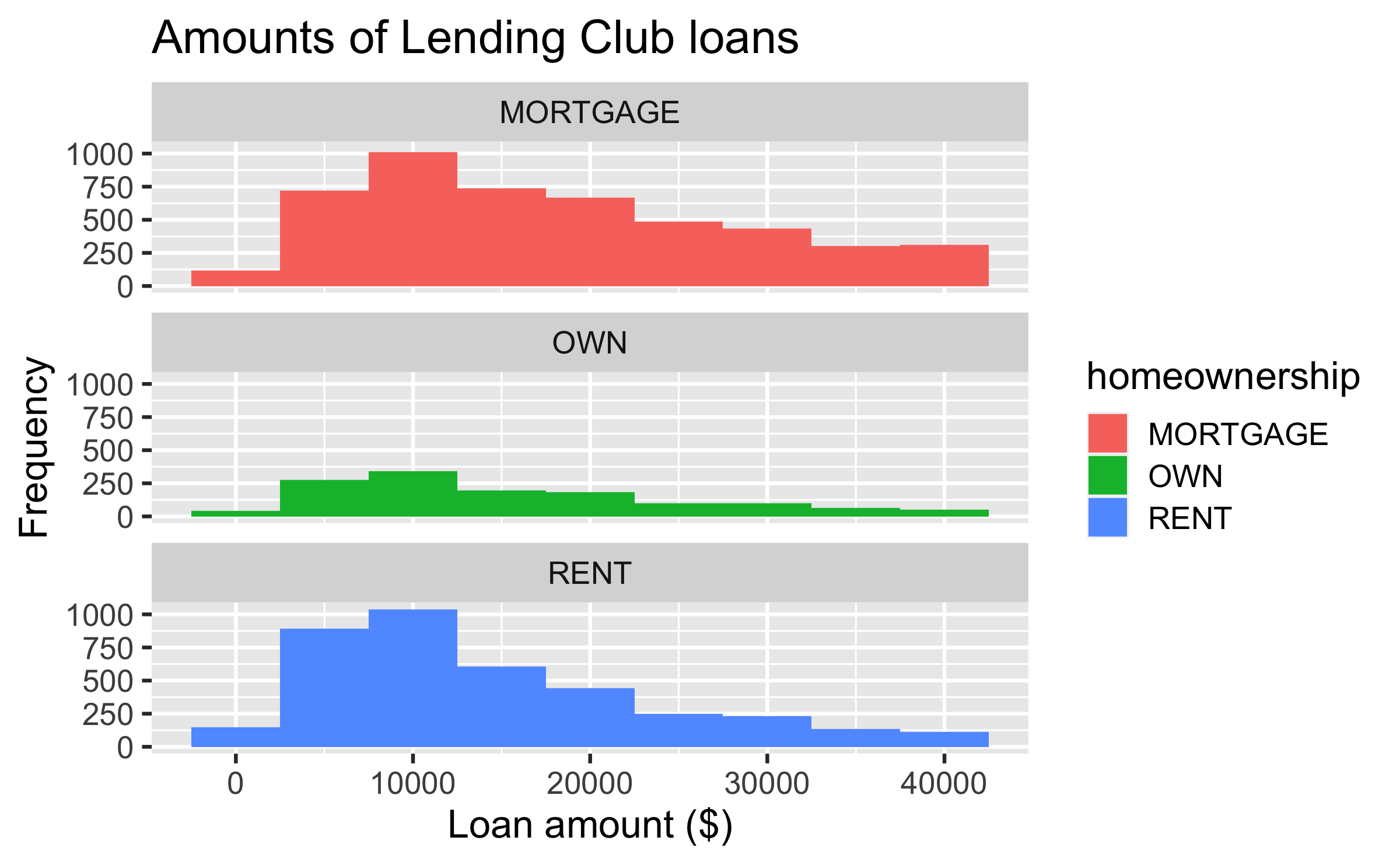

Facet with a categorical variable

ggplot(loans, aes(x = loan_amount, fill = homeownership)) + geom_histogram(binwidth = 5000) + labs( x = "Loan amount ($)", y = "Frequency", title = "Amounts of Lending Club loans" ) + facet_wrap(~ homeownership, nrow = 3)18 / 32

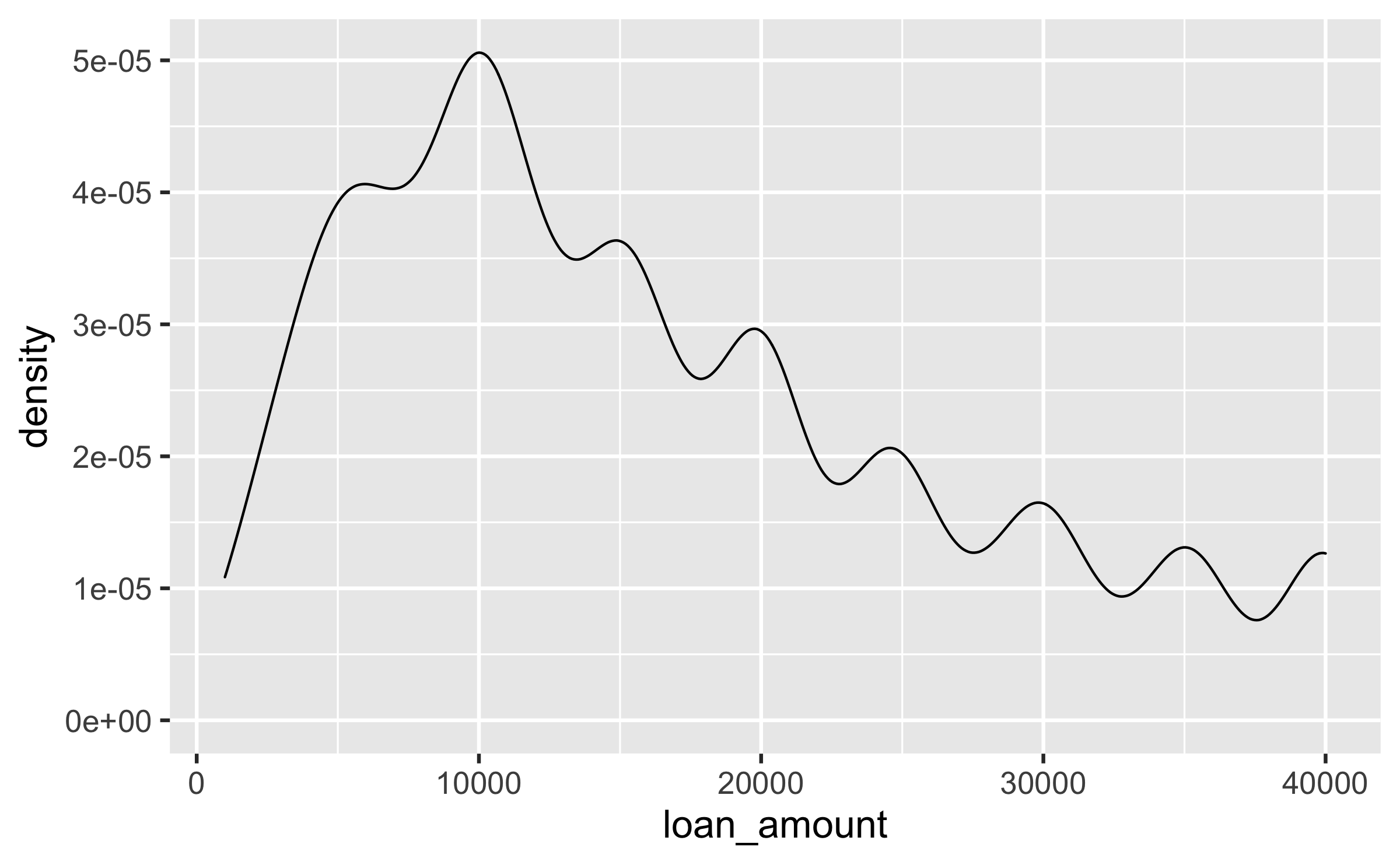

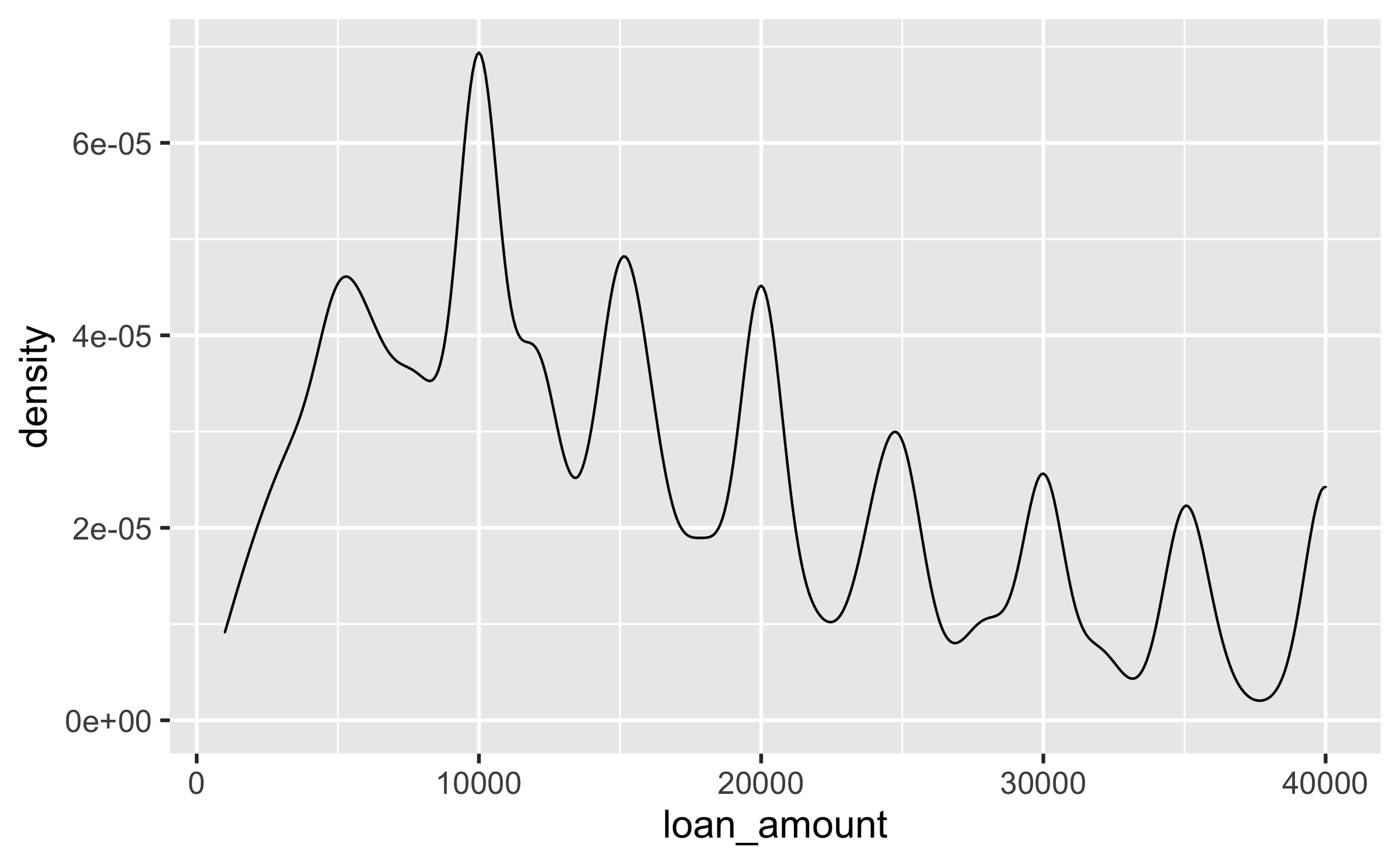

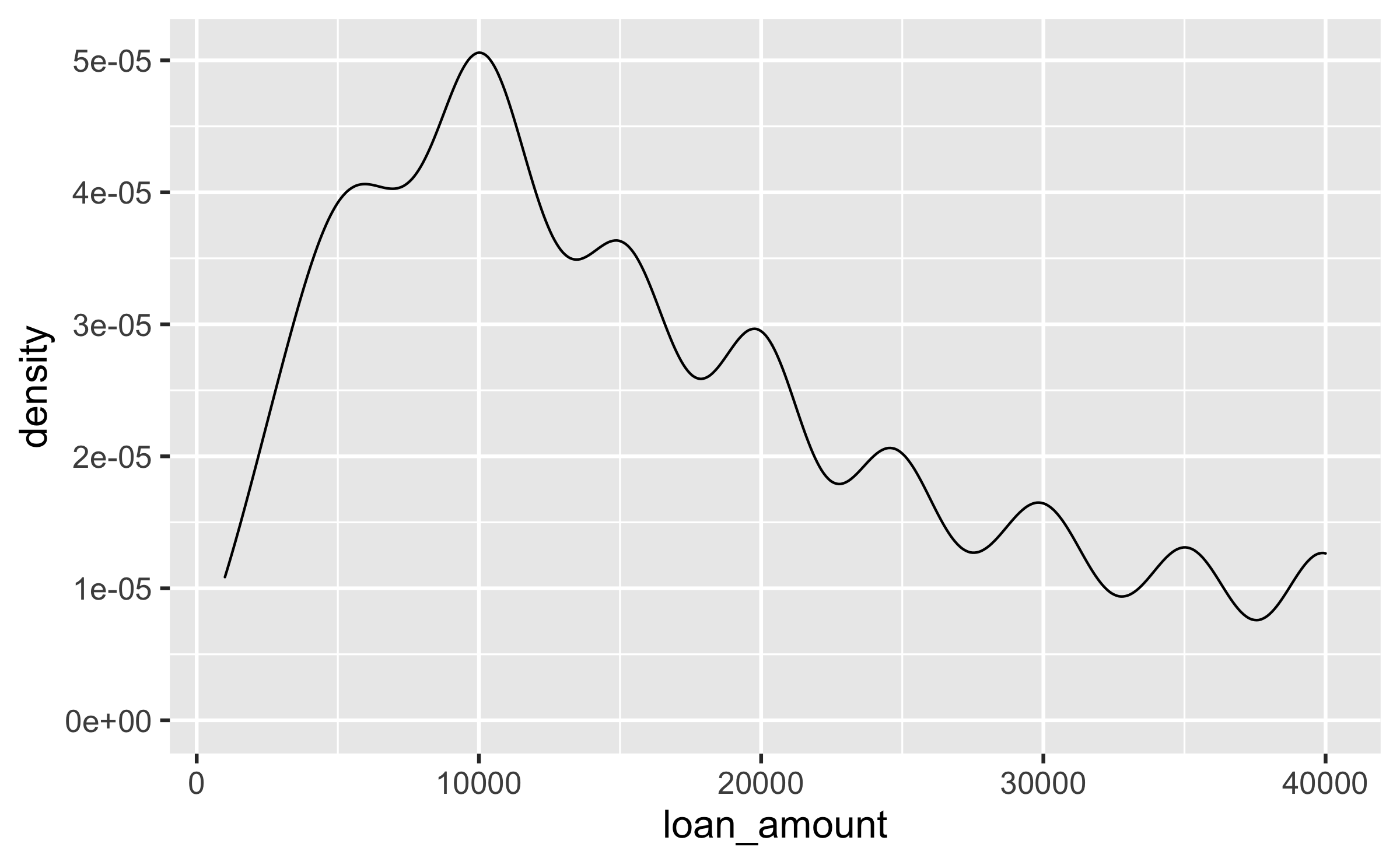

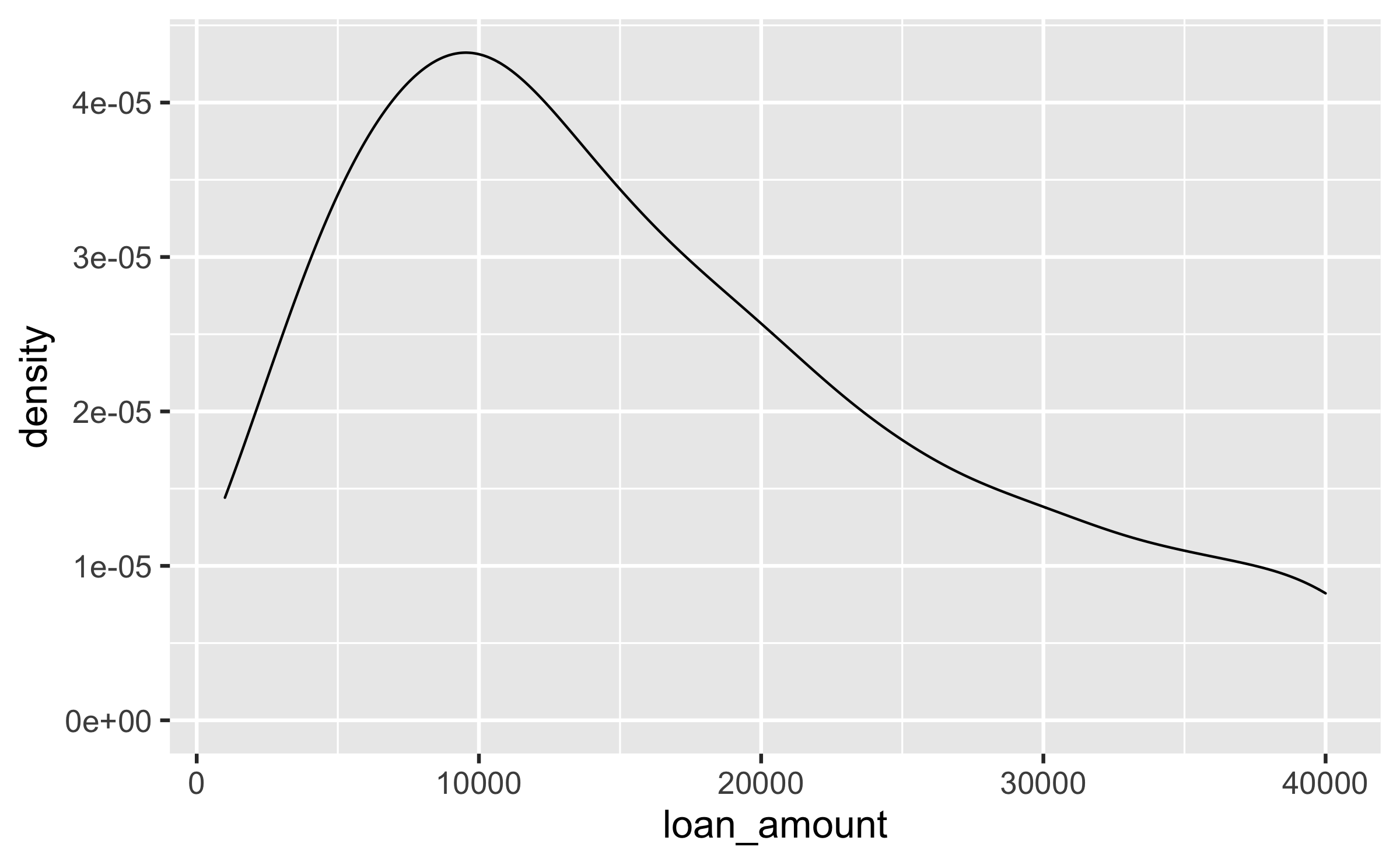

Density plots and adjusting bandwidth

ggplot(loans, aes(x = loan_amount)) + geom_density(adjust = 0.5)

ggplot(loans, aes(x = loan_amount)) + geom_density(adjust = 1) # default bandwidth

ggplot(loans, aes(x = loan_amount)) + geom_density(adjust = 2)

21 / 32

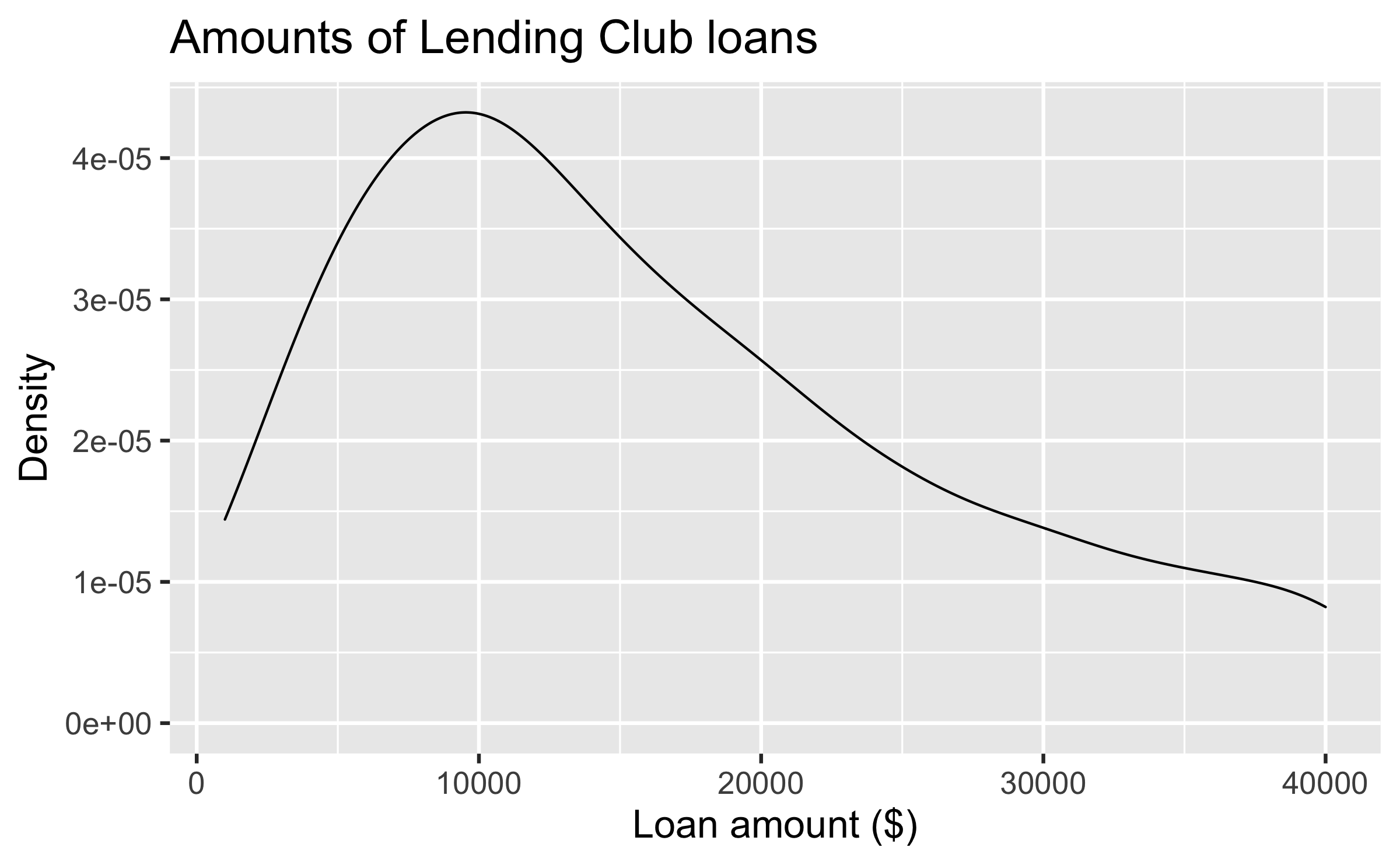

Customizing density plots

ggplot(loans, aes(x = loan_amount)) + geom_density(adjust = 2) + labs( x = "Loan amount ($)", y = "Density", title = "Amounts of Lending Club loans" )22 / 32

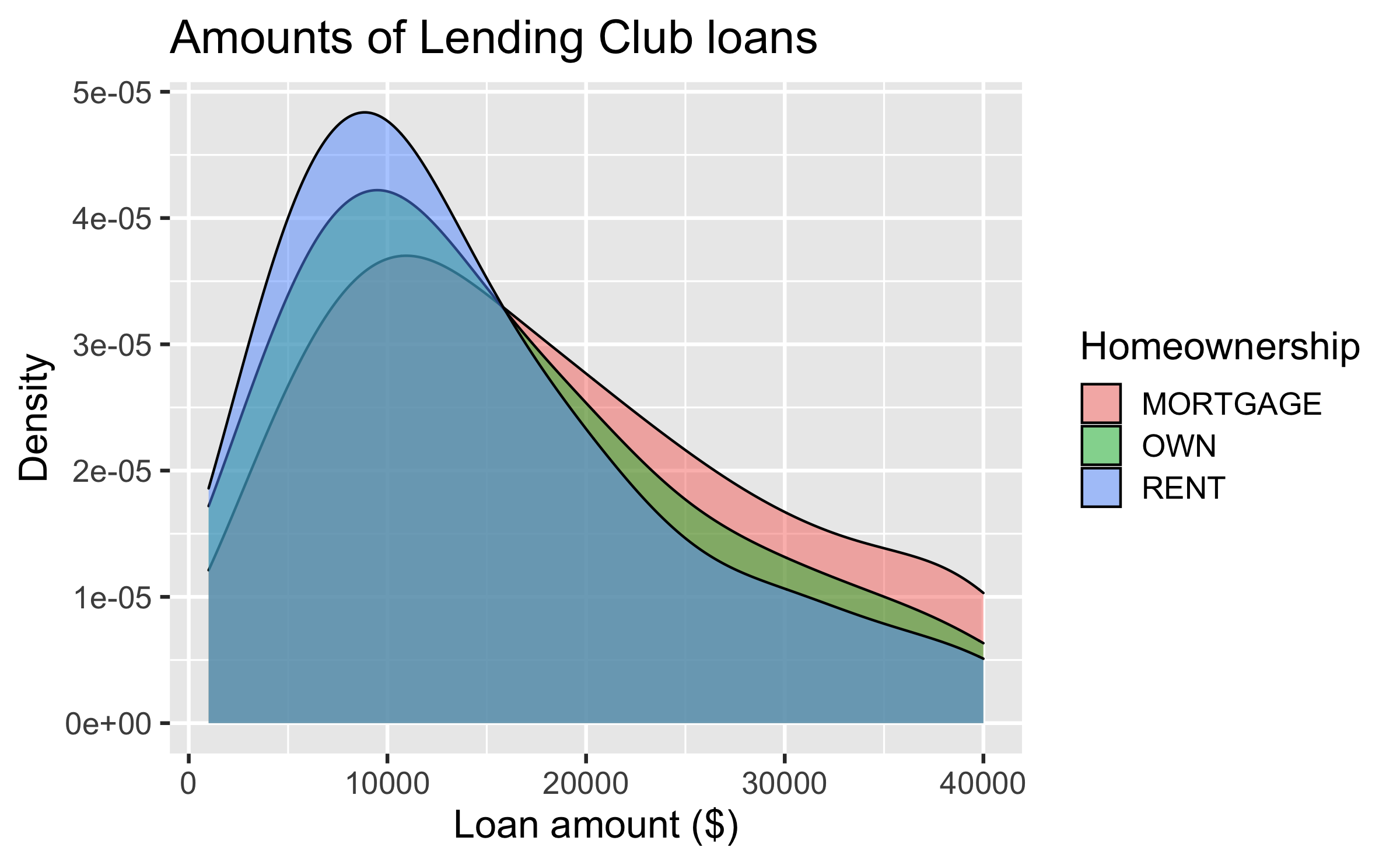

Adding a categorical variable

ggplot(loans, aes(x = loan_amount, fill = homeownership)) + geom_density(adjust = 2, alpha = 0.5) + labs( x = "Loan amount ($)", y = "Density", title = "Amounts of Lending Club loans", fill = "Homeownership" )23 / 32

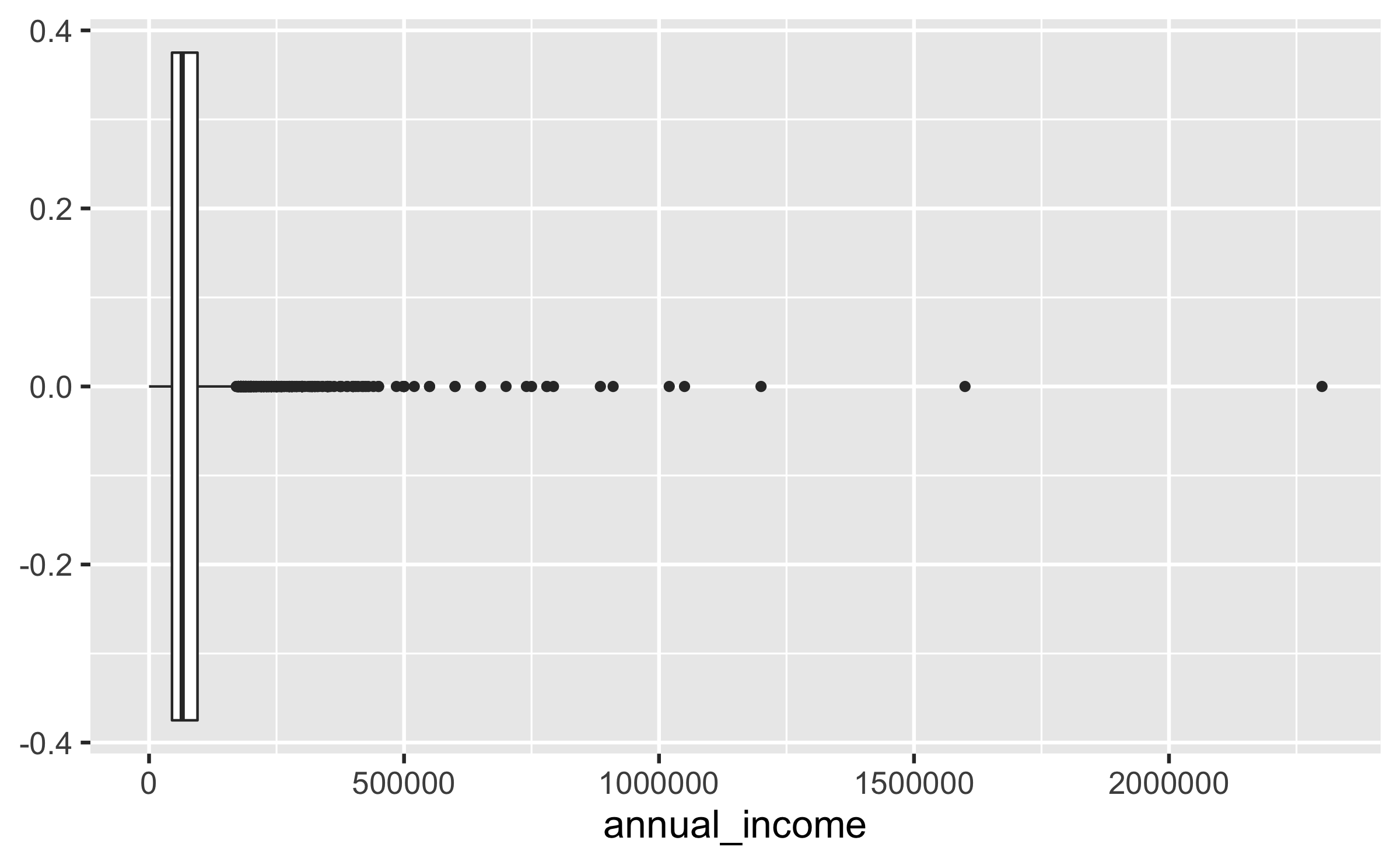

Box plot and outliers

ggplot(loans, aes(x = annual_income)) + geom_boxplot()

26 / 32

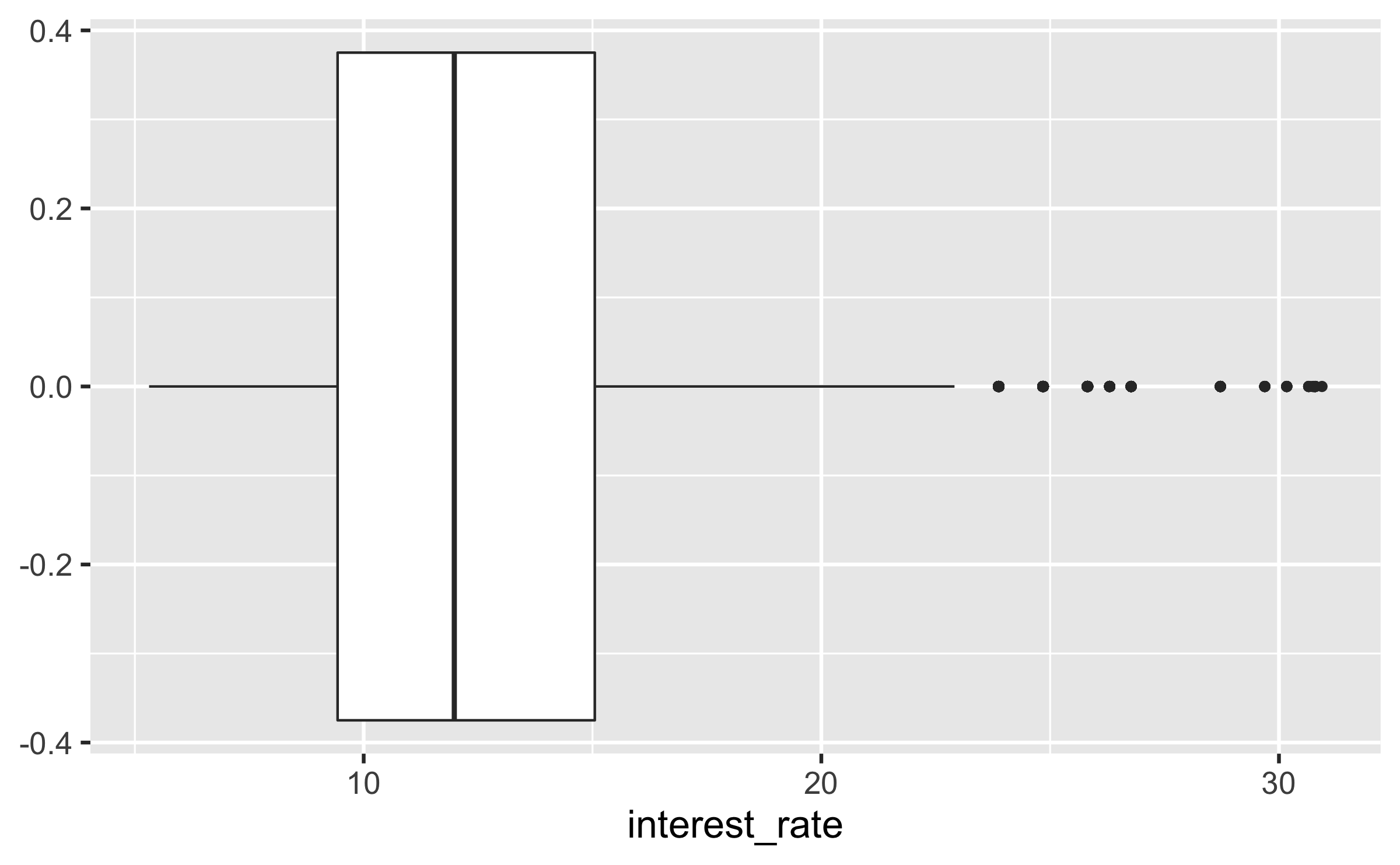

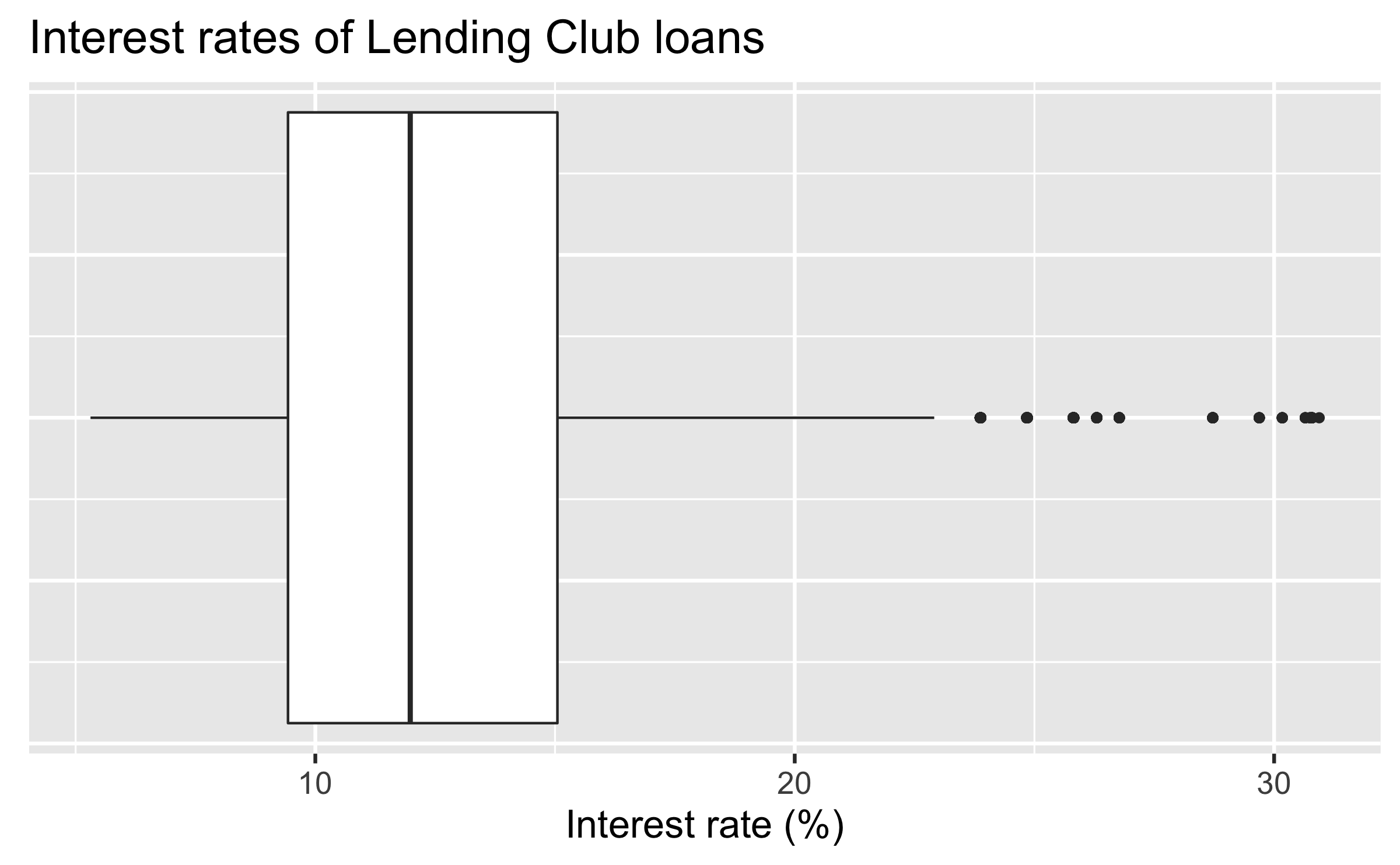

Customizing box plots

ggplot(loans, aes(x = interest_rate)) + geom_boxplot() + labs( x = "Interest rate (%)", y = NULL, title = "Interest rates of Lending Club loans" ) + theme( axis.ticks.y = element_blank(), axis.text.y = element_blank() )27 / 32

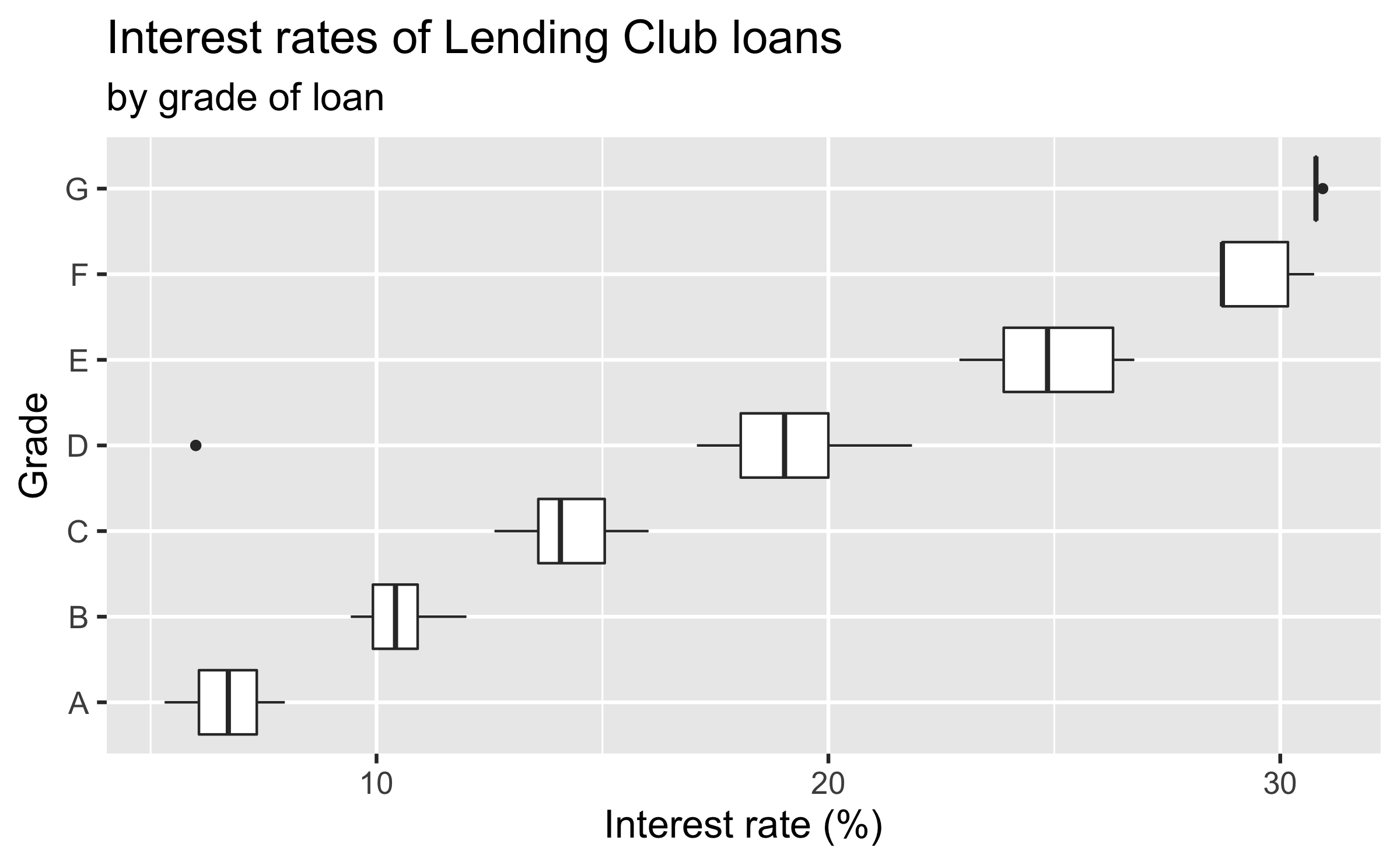

Adding a categorical variable

ggplot(loans, aes(x = interest_rate, y = grade)) + geom_boxplot() + labs( x = "Interest rate (%)", y = "Grade", title = "Interest rates of Lending Club loans", subtitle = "by grade of loan" )28 / 32

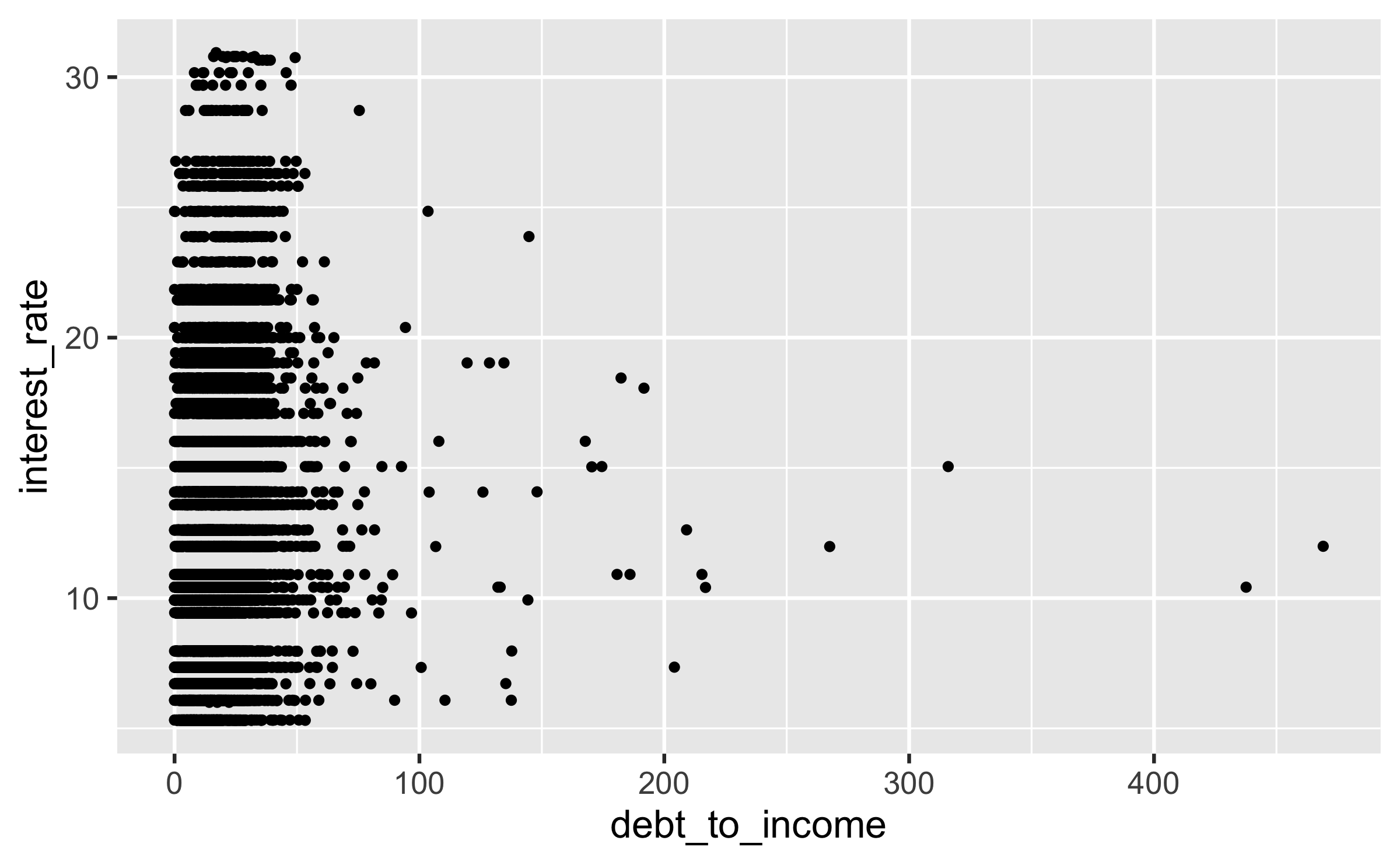

Scatterplot

ggplot(loans, aes(x = debt_to_income, y = interest_rate)) + geom_point()

30 / 32

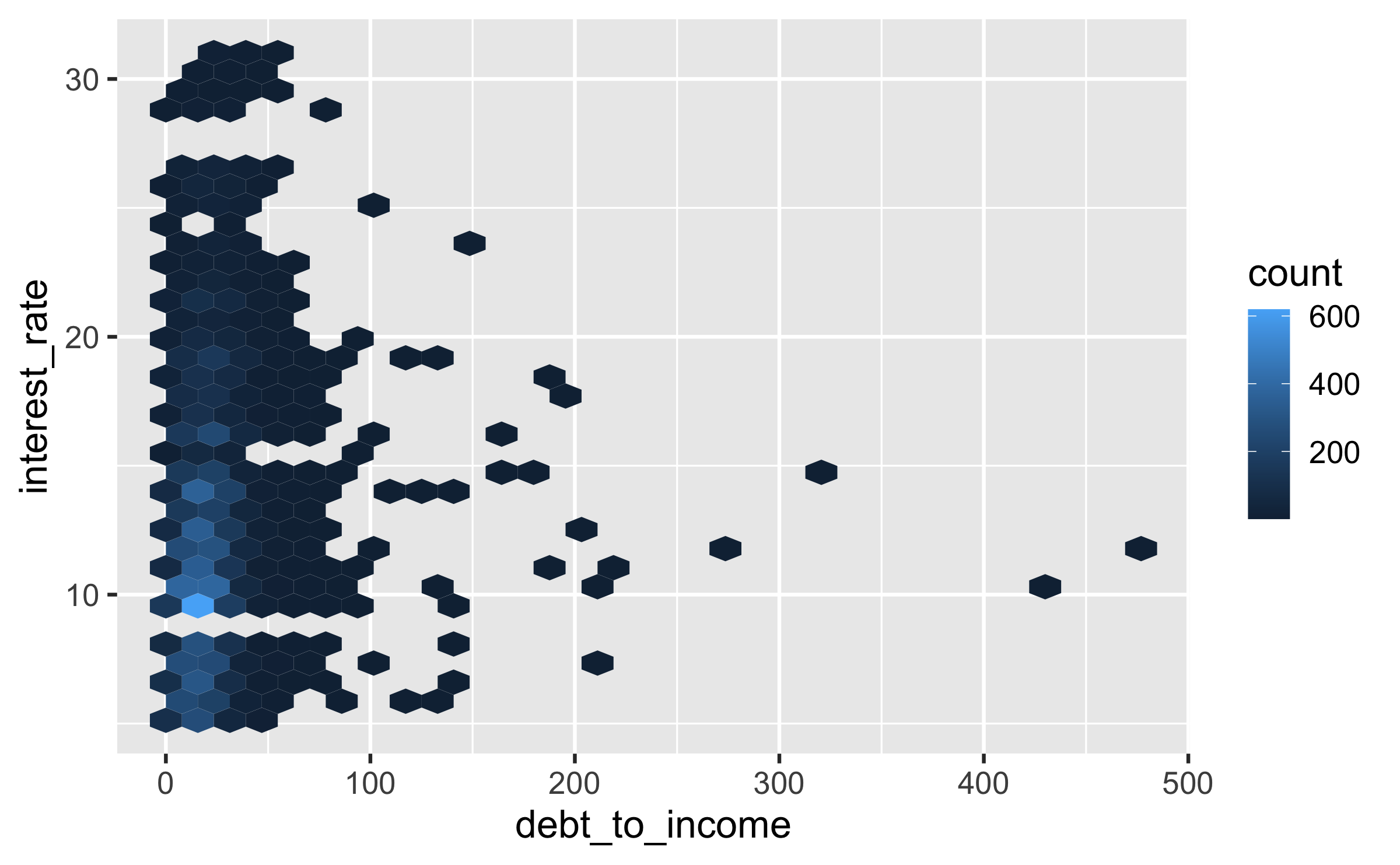

Hex plot

ggplot(loans, aes(x = debt_to_income, y = interest_rate)) + geom_hex()

31 / 32

Hex plot

ggplot(loans %>% filter(debt_to_income < 100), aes(x = debt_to_income, y = interest_rate)) + geom_hex()

32 / 32